Why do you need Retirement Planning

Here are reasons why retirement planning in India is pretty essential during the early years:...

Continue Reading"An investment in knowledge pays the best interest"

- Benjamin Franklin

Here are reasons why retirement planning in India is pretty essential during the early years:...

Continue Reading

Don't spend too much time on deciding where, how and when to invest. The faster you invest money, the more it earns.

Continue Reading

In general, our investing decisions are shaped by the following factors.1. Having herd mentality When people watch their neighbors, friends...

Continue Reading

When selecting a mutual fund, an investor has to make an almost endless number of choices.

Continue Reading

First time mutual fund investors are often confused about the concept of Net Asset Value (NAV) of a mutual fund scheme.

Continue Reading

Schemes which do not invest in Equity or Equity related instruments are termed as Debt Funds, These funds do not invest in share market...

Continue Reading

Investing is not just about picking winners, but also about avoiding mistakes. Retail investors can be better off if they avoid making the following mistakes.

Continue Reading

Here are a few personal finance tips that young professionals would well to be aware of...

Best mutual fund scheme does not mean the best in returns, but the one best suited to your

risk profile and goals and the one that is good in its peer group.

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds.

Planning your taxes is an integral part of your financial planning. Sec 80C of the Income Tax Act allows you to claim deductions upto 1.50 lakhs...

Continue Reading

Great Warrior needs a coach! Even God of Cricket needs a coach...

In general, our investing decisions are shaped by the following factors:

When people watch their neighbors, friends and colleagues making money in the particular asset class (Stock Market, Gold, Real Estate), they feel left behind. Then they start doing the same thing in a bid to make money, which is the biggest mistake they make. One must remember that everyone has some plans and strategies about their investments. Therefore, copying their investment strategies may not suit you and you might even end up losing substantial money. It is in your own interest, therefore, not to follow others.

We as human beings are greedy by nature and are never satisfied - be it our

compensation or investment return, we want more of everything. This sometimes

makes us set unrealistic targets which are unachievable. Therefore, it is important for us

to set realistic targets.

For example Investor looking for 20% return from Equity Market in 1year.

It is a very common perception that because an asset class has done well in the past one year,

it's the best asset to invest in. Retail investors do not realise that often the best performers will

underperform the market in the future because their optimistic outlook has already been

priced.

Don't go after hot sectors that are currently producing high returns. Don't let greed drive your

investment decisions. Look forward to see whether the gains produced in the past can get

repeated or not. Short-term trends of the past might not get repeated in the future.

While there is need for investors to focus on making logical, careful decisions that

support a long-term goal like retirement, a person's emotions can cloud his investment

decisions, leading to choices that are not in his best interest. For example, when

markets remain bearish for a long time, some investors lose patience and sell their

stocks at rock-bottom prices, incurring losses. On the other hand, "sometimes some

people buy shares of unknown companies without really understanding the risks

involved. Thus, instead of creating wealth, such investors burn their fingers very badly

the moment the sentiment in the market reverses.

Therefore, don't let either fear or greed cloud your judgment.

Some Investors keep on churning their portfolio in order to identify the best performing fund. One has to understand that it's very difficult for an asset class to consistently deliver the high returns. Churning your portfolio will result in very ordinary returns. We suggest investors to identify their objective and stick to it despite of market conditions.

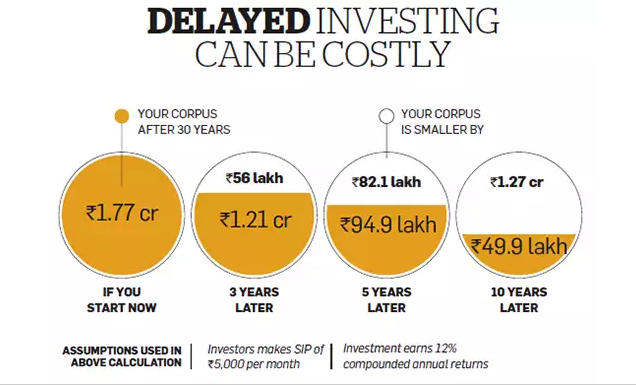

Don't spend too much time on deciding where, how and when to invest. The faster you invest money,

the more it earns.

A delay in making an investment can lead to a loss. The accrued interest on the investment for the

duration of the delay can have a significant effect on the net returns.

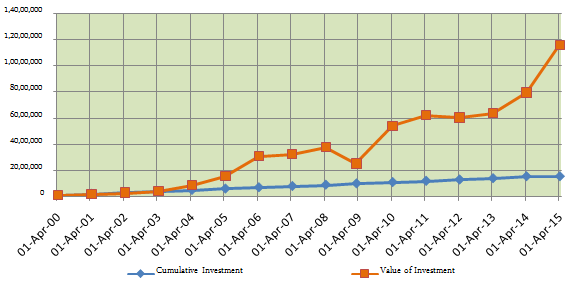

If an investor starts an investment of Rs 5,000 in a fund that gives 12% returns, he will accumulate Rs

1.77 crore in 30 years. But if he delays his investment by just 3 years his corpus will be Rs 1.21 Cr,

smaller by 56 lakh.

Many young earners don't start investing because they believe their income is low & they can start

investing later. But this is not true. With the passage of time, Individual responsibilities grow & his ability

to take risk gradually decreases. If invested late when the risk appetite lowers due to the newer

financial goals and other responsibilities, Individual investments may get overshadowed.

An Investor can Start Investment with the amount he is comfortable with, with the passage of time one

can increase the investment amount.

Investing is not just about picking winners, but also about avoiding mistakes. Retail investors can be better off if they avoid making the following mistakes.

A bull market makes retail investors believe that they are geniuses - after all, anything they put

money into goes up. This overconfidence in their own abilities leads to a complete disregard of

the risks involved.

Every new generation that invests in the market ignores past experience. These new investors

wrongly believe that stock prices only go up.

Don't be overconfident and don't start believing that you have superior skills compared to the

market. Recognise that in a bull market you are benefiting because the whole market is going

up. If those around you are getting unrealistically optimistic, start managing your risk

accordingly. Remember that sometimes markets do come crashing down.

Good batsmen realise that some balls outside the off-stump should be left alone. Similarly,

professional investors realise that sometimes its better to just stand still than to rush into a

stock. Retail investors often make the mistake of "flashing outside the off-stump" because they

cannot resist the temptation to trade in every opportunity. And, like an inexperienced batsman,

they suffer the same fate.

Too much trading will lead to a lot of churn, which results in missing out the real returns. Some

of the world's best investors follow a buy and hold strategy - you should too.

Albert Einstein has said that compounding of capital is the 8th wonder of the world because

it allows for the systematic accumulation of wealth. Even though any one in class 5 could tell

you how compounding works, retail investors ignore this basic concept.

Compounding of capital can benefit you only if you leave your money uninterrupted for a long

period of time. The sooner you start investing, the bigger the pool of capital you will end up

with for your middle aged and retirement years.

Don't wait to start investing only when you have a large amount of money to put to work. Start

early, even if it's with a small amount. Watch this grow to a very large amount with the passage

of time.

Retail investors are obsessed with the question "Where do you think the market will go?" This is a wrong question to ask. In fact, no one knows the answer.

The right question to ask is whether the fund in which you are investing, is going to give good

returns 10 years from now or not? Don't take a view on the market, take a view on long-term

industry trends and how your chosen companies can create value by exploiting these trends.

Its very difficult to time the market, i.e, be smart enough to buy at the absolute bottom and sell

at the absolute top. Professionals understand that timing the market is a wasted exercise.

Retail investors always wait for that elusive best opportunity to get in or to get out. But by

waiting they let great investment opportunities go by. You should use systematic or regular

investment plans to make investments. You'll have to make fewer decisions and yet can

accumulate substantial wealth over time.

The best opportunity to buy is when the markets are falling and there is fear in the minds of

investors. Yet, many retail investors do exactly the opposite. They sell when the markets are

falling and buy only when the markets are high. This way they end up losing twice - by selling

low and buying high, when they should be doing exactly the opposite.

If nothing has changed about the long-term outlook for the company that you own, then you

should not sell this company's stock. Use this opportunity to buy more of the same stock in

falling markets. Some of the world's biggest fortunes were made by buying when others were

selling in panic.

It is a very common perception that because a stock has done well in the past one year, it's the

best stock to invest in. Retail investors do not realise that often the best performers will

underperform the market in the future because their optimistic outlook has already been

priced into the stock.

Don't go after hot sectors that are currently producing high returns. Don't let greed drive your

investment decisions. Look forward to see whether the gains produced in the past can get

repeated or not. Short-term trends of the past might not get repeated in the future.

Beyond a point, having too many names in a portfolio can be counterproductive. You might end

up duplicating, or end up taking too much exposure to a sector. Over-diversification can upset

your portfolio, especially when you have not done enough research on all the companies you

have invested in.

If you are an active investor in the stock market, maintain a manageable portfolio of 15-25

names. Instead of adding new names to this portfolio, recognise ideal ones. Then back them

with more capital. In the long run, this will produce better returns for you than adding another

20 names to your portfolio.

Investing is all about patience and discipline. By avoiding mistakes you can improve the long-

term performance of your portfolio, whatever the economic conditions prevailing in the

market.

Schemes which do not invest in Equity or Equity related instruments are termed as Debt Funds, These funds do not invest in share market, these schemes invest in Fixed return yielding instruments like Corporate Bonds, Commercial Papers, Treasury Bills, Government Securities and Debentures.

Relatively these schemes are less risky than equity market & are suitable for investors looking for safe & consistent returns. Any risk averse investors looking to invest in mutual funds can opt for these schemes.

Consider the following while choosing an appropriate Debt Mutual Fund -

1. Modified Duration - Higher the modified duration, higher will be the Volatility,

2. Portfolio Quality - better the Portfolio Quality, safer will be the fund, always choose a fund with AAA or AA rated funds in portfolio

3. Yield to Maturity (YTM) - Higher the YTM, better the fund.

Here are a few personal finance tips that young professionals would well to be aware of:

First step towards financial planning is to make sure you have adequate life Insurance cover. You can choose HLV (Human Life Value) calculator to ascertain how much insurance is required.

Young professional can opt for the Term plan, & at a young age the premium amount will be very affordable.

Split your goals into three categories: short-, medium- and long-term goals. Then list each one clearly, along with the number of years to achieve each, and the exact amount you will need. Once you have penned down your goals, you will be able to determine how much and for how long you will need to invest.

Don't put all your eggs in one basket. You must get your asset allocation right. It is not wise to have all your assets in equities even if you are very young.

Invest in Sovereign Gold Bonds, REITS, INVITS, NPS apart from Mutual Funds & Fixed return instruments.

Why pay dual tax on same income. First we pay tax on our income, and then we invest the amount in instruments which are taxable. Invest in asset class which offers tax free returns.

Do not take advice from your friends/colleagues/ family members. Their personal experience towards a particular asset class may differ from you.

If your friend/colleague who has burnt his hands in equity market, he may never advice you to invest in Equity. Your risk appetite & requirement may differ.

Consult your financial advisor, he will ascertain your requirement and can suggest you right asset class to invest.

First time mutual fund investors are often confused about the concept of Net Asset Value (NAV) of a mutual fund scheme. Most of them wonder whether they should buy a fund with a higher or lower NAV. You cannot view a mutual fund unit like a share. There is no 'saturation point' as far as the growth of the Net Asset Value of a fund is concerned. An individual stock may get over valued if its price shoots up, but that is not the case with a mutual fund.

The NAV of a mutual fund scheme is the market price or the value of its assets minus its liabilities per unit. The NAV represents the fund's intrinsic worth. Higher or lower NAV is irrelevant if the fund performance is considered.

For example, suppose you are investing in two schemes with same portfolios. One scheme has been around for a while, so it has a higher NAV. The other scheme, a relatively younger one, has a lower NAV. This means, the investor would get more number of units in the scheme with lower NAV and less units in the scheme with the higher NAV. However, both would get the same returns as the appreciation or deprecation of investments of the scheme would be same as they have identical portfolios.

The NFO or new fund offer, as the name suggests, is the new launch of a fund. The fund would collect money from investors first, and invest it on their behalf later. That is why it is offering units at Rs 10. An existing fund, on the other, has already made investments. Depending on its performance, the NAV would be higher or lower than Rs 10. Avoiding a scheme with a higher NAV is unwise because you are actually penalising it for performing better.

When selecting a mutual fund, an investor has to make an almost endless number of choices. Among the more confusing decisions is the choice between a fund with a growth option and a fund with a dividend option. Each type of fund has its advantages and disadvantages, and deciding which is a better fit will depend on your individual needs and circumstances as an investor.

Under growth option, dividends are not paid out to the unit holders.

Income generated to the Unit holders continues to remain invested in the Scheme and is reflected in the NAV of units under this option. Investors can realize capital appreciation by way of an increase in NAV of their units by redeeming them. The growth option is not suitable for the investor who wishes to receive regular cash payouts from his/her investments.

Investor looking to create wealth with a longer time horizon should opt for the Growth option.

The dividend reinvestment option is quite different. Dividends that would otherwise be paid out to investors are reinvested in the scheme to purchase more units in the fund. Again, cash is not paid out to the investor when dividends are paid by the fund. Instead, cash is automatically used by the fund Manager to buy more units on behalf of the investors.

Usually Investors who doesn't have immediate cash flow requirement, but in future can require regular cash flow opt for dividend reinvestment option.

Investor can change the option from Dividend reinvestment to dividend Payout based on his requirement, without paying any charges/exit load.

For e.g : Investors planning for Child education, looking for quarterly cash flow after 3 yrs, can opt for dividend reinvestment option now & later on when cash flow is required can opt for dividend payout.

With respect to fund performance Growth Option & Dividend payout/reinvestment delivers the same returns. Since the portfolio of the scheme is same there is no difference with regard to fund performance. Returns of both the options will almost remain the same.

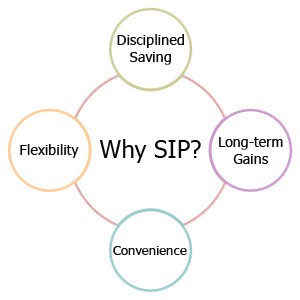

A Systematic Investment Plan or SIP is a smart and hassle free mode for investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future.

A SIP is a flexible and easy way to plan investment. Your money is auto-debited from your bank account and invested into a specific mutual fund scheme. You are allocated certain number of units based on the ongoing market rate (called NAV or net asset value) for the day.

Every time you invest money, additional units of the scheme are purchased at the market rate and added to your account. Hence, units are bought at different rates and investors benefit from Rupee-Cost Averaging and the Power of Compounding.

Most investors remain skeptical about the best time to invest and try to 'time' their entry into the market. Rupee-cost averaging allows you to opt out of the guessing game. Since you are a regular investor, your money fetches more units when the price is low and lesser when the price is high. During volatile period, it may allow you to achieve a lower average cost per unit.

Albert Einstein once said, "Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it." The rule for compounding is simple - the sooner you start investing, the more time your money has to grow. With a small contribution on a monthly basis, investor can accumulate a large corpus & can achieve their desired objective.

1. Disciplined Saving - Discipline is the key to successful investments. When you invest through SIP, you commit yourself to save regularly. Every investment is a step towards attaining your financial objectives.

2. Flexibility - While it is advisable to continue SIP investments with a long-term perspective, there is no compulsion. Investors can discontinue the plan at any time. One can also increase/ decrease the amount being invested.

3. Long-Term Gains - Due to rupee-cost averaging and the power of compounding SIPs have the potential to deliver attractive returns over a long investment horizon.

4. Convenience - SIP is a hassle-free mode of investment. You can issue a standing instruction to your bank to facilitate auto-debits from your bank account.

SIPs have proved to be an ideal mode of investment for retail investors who do not have the resources to pursue active investments

If you have invested 1 lakh rupees every year in PPF & ELSS scheme, after 15 years your valuation in PPF account would be 30.32 lakh, whereas ELSS valuation would have been grown to whooping 1.20 Cr.

Copyright © 2018 assetbaazar.com All rights reserved.

"Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns"